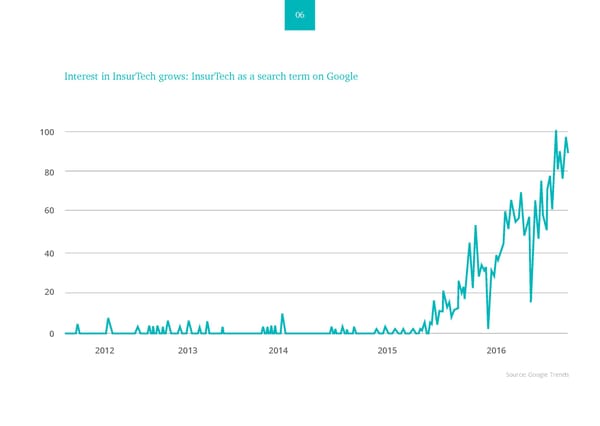

07 Amid the buzz, InsurTech businesses have themselves begun to grow up, at- Despite the general upward trend, investment in Q1 2017 was disappoint- tracting interest from both traditional insurers and an audience beyond the ing, according to data from CB Insights and Willis Towers Watson, and down insurance industry. “InsurTech is no longer the new kid on the block,” says Ori on the same quarter in the previous year by a significant $500m - although Hanani from the insurer Admiral’s French operation. only down by $20m when solely early stage investments are considered. It is too early to say whether this trend will continue but some commentators An often cited example is Lemonade, the US technology-driven property are now noting that investment isn’t matching the hype. and casualty insurance company, which has been hitting the headlines this year - it grabbed particular attention after settling a claim in a world record However, there is certainly money out there. Multiple corporate venture 3 seconds. And there are examples closer to home such as Startupboot- capitalists and funds have targeted the InsurTech space and announced camp alumni Buzzmove, which has raised £6m of investment since leaving large sums to invest. At the time of writing, for example, QBE recently an- the accelerator last year and launched buzzVault, a new service aimed at nounced a plan to invest $50 million into InsurTech, WR Berkley created a customers who want to “protect, manage and store” their belongings in a new role focussed solely on InsurTech investment and IA Capital Group are “digital vault”. looking to insurers to build a $100 million InsurTech war chest. Offerings such as these are attracting the significant amounts of funding The low investment figures in Q1 of this year may be a symptom of In- now flowing into InsurTech businesses. Indeed, the flow of capital into In- surTech’s youth. With two thirds of deals at seed or series A level in 2016 surTech underlines its growing significance and perceived future value. there simply aren’t enough InsurTechs of scale (yet) to send investment 1 dollars higher. There just aren’t that many later stage start-ups raising the In 2016, we saw more deals in the InsurTech sector than ever before, larger sums to do so. As some of those early stage investments begin to with 173 separate transactions according to CB Insights, a 42% increase on find their feet it is possible that we will start to see significant deals more the previous year. And as Figure 1 reveals $1.69bn was invested into In- regularly. It may also be that those looking to invest are conscious of the surTech start-ups during 2016, the second year running in which these com- buzz around InsurTech, wary of inflated prices, and are resultantly biding panies attracted more than $1bn of investment. While that was lower than their time. the record $2.67bn of investment seen in 2015, that figure included some unusually large individual transactions, including investments of $931m in Zhong An, the Chinese full-stack insurer, and $500m in Zenefits. 1 CB Insights analysis

PwC & Startupbootcamp InsurTech: READY FOR TAKE OFF Page 5 Page 7

PwC & Startupbootcamp InsurTech: READY FOR TAKE OFF Page 5 Page 7